Options to market grain Minimum pricing contracts for growers of soft white wheat

2025December 2025

By Howard R. Nelson

Special to Wheat Life

This article is my last one covering marketing basics before we put everything together to develop a marketing plan. Unfortunately, it covers a difficult subject that is hard to cover in a short article. First, what is a minimum pricing contract (MPC)? It is a marketing tool that combines a cash sale with the purchase of a call option in the futures market. The cost of the call option is deducted from the cash price, giving you your minimum price. This type of contract allows for growers to benefit from higher prices after selling wheat in the cash market if the futures market goes up during the period that the call option is in effect.

When you start working with option contracts, the first thing that you notice is that they use a lot of unfamiliar terms. What does “out-of-the-money” mean? What is a “strike price?” What is “intrinsic value?” These are all terms that you need to understand when you use MPCs. I am not going to be able to fully explain the ins and outs of MPCs in this article, but I will do my best. This will be more of a “Cliff Notes” version to explain the basics. I would recommend that growers read the “Self-study Guide to Hedging with Grain and Oilseed Futures and Options” for more information, and it is available on the internet. You should also find an advisor that will help you make decisions when an MPC is initiated. Another issue that you will see in the following discussion is that futures prices are given in dollars per bushel ($/bu), but option prices are given in cents per bushel (¢/bu) and often the “per bushel” is omitted and considered to be understood.

Let’s go through an example of the use of an MPC during the 2025-26 marketing year. A grower decides to sell some wheat to pay some bills after harvest. Today’s date is 9/3/25, and the price of Portland soft white wheat is $6/bushel. Wheat’s trading range to date this year has been narrow, and since April 1, it has ranged only $.40/bushel between the market high and low. The grower’s cost to hold wheat is about $.055/bu (storage + interest). He talks to his advisor, and they take a look at the CBOT December call options. That contract is currently trading at $5.22/bushel. The cost of a 520 (¢/bu) December call option (closest strike price to the futures market or at the money) is just under 22¢/bu. The 520 option is slightly in-the-money, which gives it intrinsic value of 2¢/bu (522 futures price minus 520 option strike price equals 2 cents intrinsic value). The balance of the cost of the option, 20 ¢/bu, is called time value. The time value slowly decreases each day as the option contract moves towards its expiration date. On the day the options expire, out-of-the-money options expire worthless, and in-the-money options are valued at their intrinsic value. This choice, the 520 call option, gives the grower a minimum price of $5.78/bushel Portland ($6/bu Portland minus 22¢/bushel option cost). The grower would like a higher minimum price, so he takes a look at an out-of-the-money 540 call option (the December futures market needs to go up $.18/bushel to reach the 540 level, which makes that option out-of-the-money (no intrinsic value). The cost of this option is 14¢/bu, which would give us a minimum price of $5.86/bu Portland ($6/bu Portland soft white wheat minus 14¢/bu option cost). Option contracts expire in the month prior to the futures contract month, and the December options expire on Nov. 21, 2025.

Let’s compare the break-even prices for the two choices or the price that the futures contract must reach where if the call option was exercised (converted to a futures contract) the gain in the futures market would cover the cost of the purchase of the call option. The break-even price for the December 520 call option is $5.42/bushel (520 strike price + 22¢/bu call option cost). The December futures contract will need to go up 20¢/bu to reach the break-even price. The break-even price for the 540 call option is $5.54/bushel (540 strike price +14¢/bu call option cost). The December futures contract will need to go up 32¢/bu to reach the break-even price.

The majority of the time, wheat growers will utilize MPCs during the fall or early winter as they market their grain in the cash market. The strategy of using an MPC would be to generate cash flow for the grower by selling wheat in the cash market and replace those bushels with paper bushels in the futures market. Those paper bushels will increase in value if the futures markets go up. Selling those bushels stops your cost of holding grain, which helps justify the cost of the call option.

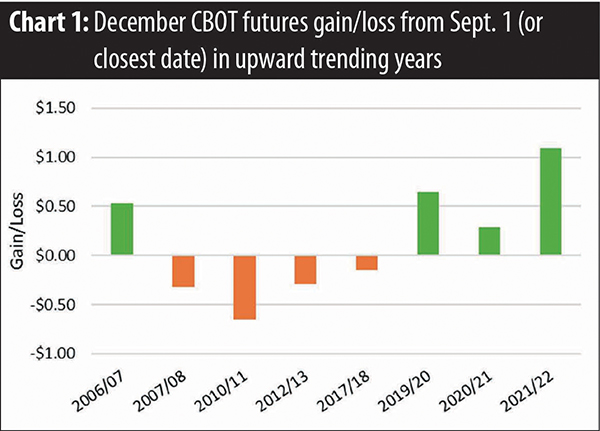

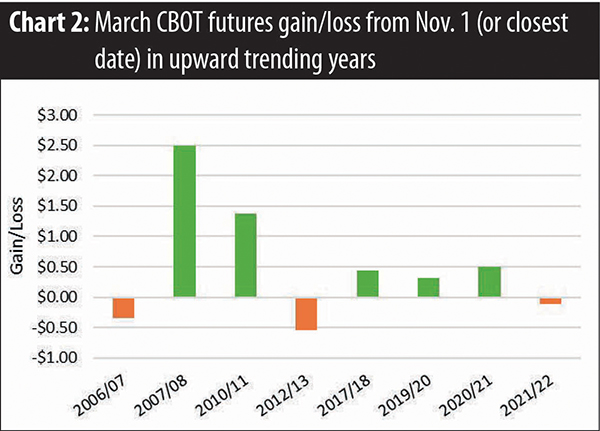

We would generally be utilizing CBOT December options that expire in November or CBOT March options that expire in February. Let’s look at the increase in the futures markets if we had chosen to implement an MPC in the eight years we have had upward trending markets since 2006. We would expect the intrinsic value of the option to match the futures market gain. We’ll look at the December and March CBOT futures gain/loss if we had implemented MPCs on Sept. 1 (or closest trading day) using the December futures contract and Nov. 1 (or closest trading day) using the March futures contract. Chart 1 shows the upward trending years and futures change for the December futures, and Chart 2 shows the change for the March contract for the period we are interested in.

The first thing you will notice is there were futures gains for the December contract 50% of the years and 62% of the years for the March contract for the eight years. In addition, the futures increase doesn’t necessarily mean that an MPC would have returned a gain. A gain would require that the futures price exceeds the break-even price for the option strategy that was chosen. If you paid 18¢/bu for a call option that was 20¢ out-of-the-money, the futures gain would need to exceed 38¢/bu for you to break even. This lowers the number of years that this strategy would be successful. One strategy that we have used to limit losses is to evaluate our position when the value of the call option reaches 50% of the purchase price. We may decide to buy our call option back at that time rather than continue holding and take the whole loss.

I hope that you have been able to get through this discussion without too much trouble. As you can see, MPCs are more complicated than other marketing tools. I used the marketing year 2025-26 to help explain the terms and prices that were experienced, but an MPC would not have been recommended this year. MPCs would not be used when the market is downward trending. MPCs are advertised as a way growers can add to their price if the market goes up after they have marketed their wheat. In reality, the actual results don’t always match the expectation. My next article will be about making a marketing plan, putting together the marketing tools we have discussed, and utilizing them in their proper marketing situations.

Howard Nelson is a retired agronomist and commodity broker. He worked for 31 years in the PNW grain industry and retired in 2020 from HighLine Grain Growers. He has a bachelor’s degree in agronomy from Washington State University and currently lives in Kennewick, Wash., with his wife, Cheryl. Nelson can be contacted at howardnelson73@gmail.com.

The information in this presentation should not be considered a solicitation. Past performance, whether actual or indicated by simulated historical tests of strategies may not be indicative of future results. Trading advice reflects good faith judgment at a specific point in time and is subject to change without notice. There is no guarantee that the advice given will result in profitable trades. Any strategy that involves trading futures or option contracts can involve losses that may be substantial and not suitable for everyone. Each person should carefully consider if trading futures is appropriate because of your financial condition.