Exploring crop insurance subsidies

2025February 2025

By Curtis Evanenko

McGregor Risk Management Services

Glad tidings and happy new year! Yes, we’re into February, but it’s still the new year, yes? I don’t believe “you have just 330 +/- shopping days until Christmas” would be preferred, though I’ve been wrong before.

Let’s chat about premium subsidies for multiperil crop insurance and the basic premise surrounding it. The Federal Crop Insurance Corporation (FCIC) was created in 1938, following the Great Depression and the Dust Bowl. Initially, this was an experiment. Crop insurance was limited to the major crops and primary production areas. Crop insurance remained an experiment until the passage of the Federal Crop Insurance Act of 1980.

The 1980 act expanded the program to additional crops and regions of the country. The expansion was to encourage participation to replace the free disaster coverage offered under farm bills in the 1960s and 70s, which was a direct competition to the experimental crop insurance program. The 1980 act authorized a subsidy of 30% of the crop insurance premium at 65% coverage. My career began in the Homeland (North Dakota) under the 1980 act, when premium calculation was an easy, three-step process.

While additional producers enrolled in the program after the passage of the 1980 act, participation did not reach the level Congress had hoped for. Ad hoc disaster assistance was authorized after the drought of 1989, and additional ad hoc relief bills were passed in 1992 and 1993. We sustained drought conditions for crop years 1987, 1988, and 1989. The enactment of the Federal Crop Insurance Reform Act of 1994 was the result of ad hoc dissatisfaction and continued competition with ad hoc disaster monies — there was always a crop loss somewhere and a congressperson seeking re-election.

The 1994 act made crop insurance participation mandatory for producers to be eligible for U.S. Department of Agriculture benefits, such as direct payments, loans, etc. The Risk Management Agency (RMA) was formed to administer FCIC programs. Catastrophic coverage was also created at this time with a 100% subsidized premium; the producer paid a $50 per crop fee for coverage of 50% of average yield and 60% of the established price. This is also when premium subsidies were increased and maximized at the 75% coverage level. Mission accomplished — by 1998, three times the acres were insured when compared to 1988.

In 1996, Congress repealed the mandatory participation requirement; however, producers were required to purchase crop insurance or waive their eligibility for any disaster benefits made available for the crop year.

In 2000, Congress passed legislation that increased subsidies of higher coverage levels, encouraging producers to purchase higher levels of crop insurance coverage. Coverage levels at 80% and 85% were born.

Premium subsidies continue to be a point of budgetary fodder. I would argue that the policy subsidies are only realized by the insured when a payable crop loss occurs. If an insured producer has a payable loss, only then will the insured realize a subsidized premium. In a nonloss year, the insured producer pays the premium owed at a reduced cost; the cost remains the cost, policy premium is not gratis.

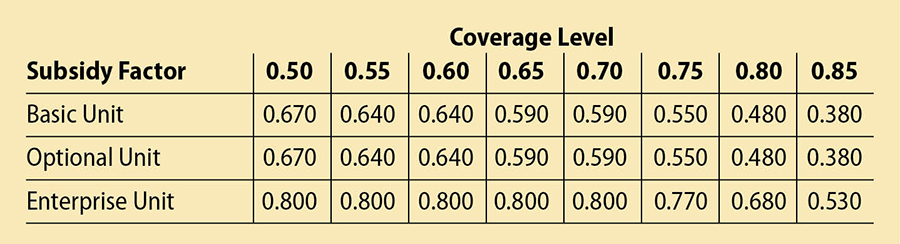

Premium subsidies are based upon the percentage of the coverage level, like your auto coverage — the lower the deductible, the higher the premium cost. The maximum premium subsidy available is at 70%. Increased coverage levels or a lower deductible decreases the premium subsidy from RMA. The appetite for risk helps determine the coverage level for an insured — the lower the risk tolerance and the greater the need for financial protection, the higher the coverage level selected.

To the best of my knowledge, premium subsidies are the same for all crops, in all counties in the U.S. The chart on the opposite page shows the subsidy made available by level and unit plan.

The premium subsidy is applied after the acres are reported and accepted by RMA and reflected on the summary of coverage received from the crop company and your agent. The summary of coverage will state a base premium dollar amount and an insured premium dollar amount, which will be base premium less subsidy to equal the insured premium. The insured premium will also have an administrative fee of $30 per crop per county.

Please feel free to contact me if you have any additional questions regarding subsidies.

Curtis Evanenko serves as a risk management advisor with McGregor Risk Management Services. He can be reached at (509) 540-2632 or by email at cevanenko@mcgregorrisk.com.