Finding the right level of crop insurance

2022January 2022

By Curtis Evanenko

McGregor Risk Management Services

How much crop insurance coverage is needed, and how do we get there?

This is an age-old question that is answered with “depends.” Please allow me to elaborate. Like beer or soda, all have different preferences and/or tolerances for risk. We believe the best outcome for crop insurance is that of “for the long haul” approach. Forge a plan and stick with it. Attempting to outguess the markets or weather is folly.

We personally work with growers that are all over the spectrum—those that have an aversion to risk and would purchase 100 percent coverage of their yield history if such coverage were available to them, as well as producers who chose the crystal-ball approach. Let’s delve into each of the groups further.

100 percent club. This group of producers looks for maximum protection, regardless of cost, and tends to maximize all inputs for maximum production. If their proven yield is 75 bushels per acre, their perfect policy would be to insure 100 percent of their historic yield average with no deductible. We can almost get there for 2022 with the ability to insure up to 95 percent of a producer’s proven yield, and, yes, this is expensive.

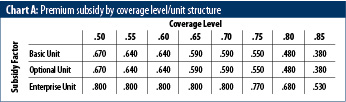

Cost vs. benefit club. This group generally has a sharp pencil and compares the bushels/dollars of coverage to the cost of said coverage with historically stable yields. Typically, 75 percent coverage level provides the maximum dollars of coverage for the premium cost. As the coverage level increases, the decreasing deductible has a correspondingly increased cost due to the reduction in the premium subsidy of the policy. Other popular choices are 80 percent coverage level with optional unit structure and 85 percent coverage with enterprise unit structure. Chart A provides the corresponding premium subsidy provided by coverage level and the unit structure for the policy.

Leveraged club. The members of this group typically have 85 percent coverage as to them, any type of a crop disaster is a potential financial impact that would plague the operation for the immediate future and potentially beyond. The financial partner(s) of the producer may dictate what coverage level and plans are chosen for the year. Depending on the operation and crop rotation(s), enterprise unit structure helps maximize coverage while maximizing premium subsidy at the same time. Enterprise unit structure provides the exact same coverage dollars as the optional unit structure, but with premium savings that can be as much as 30 percent or more depending on the number of acres and locations planted.

Not-dependent club. Often, this group is comprised of landlords who have other investments or income streams that provide for their basic needs. The objective of crop insurance for them is for protection of contributed input costs and to make sure land taxes are assured, so other, nonrelated revenue sources are not relied upon to meet said input cost obligations. Coverage level choice often matches that of the operator and can include enterprise unit structure for the landlord to help reduce premium costs.

So, how much coverage is needed for your operation and vested interest? Once again, it depends on your appetite and tolerance for risk, the financial status of the operation, and how dependent you are on the crop revenue you’re expecting for the year. Please contact me or your local agent with questions.

Curtis Evanenko serves as a risk management advisor with McGregor Risk Management Services. He can be reached at (509) 540-2632 or by email at cevanenko@mcgregorrisk.com.