A question that I’ve used in the past as an ice breaker for discussion was, “Would you sell wheat if the market price was $10 a bushel?” Growers have actually had the opportunity to do this, and some of you may have accomplished this goal as prices went higher than $10 a bushel in 2007-08 and 2021-22. But as the saying goes, what goes up must also go down. How can we protect ourselves from low prices when the market goes down? Forward pricing!

Let’s establish some guidelines for using forward pricing:

- We are only going to use it in a downward-trending market.

- We are only going to use it if we feel we are getting a good price.

- We are only going to price an amount of bushels we are comfortable doing.

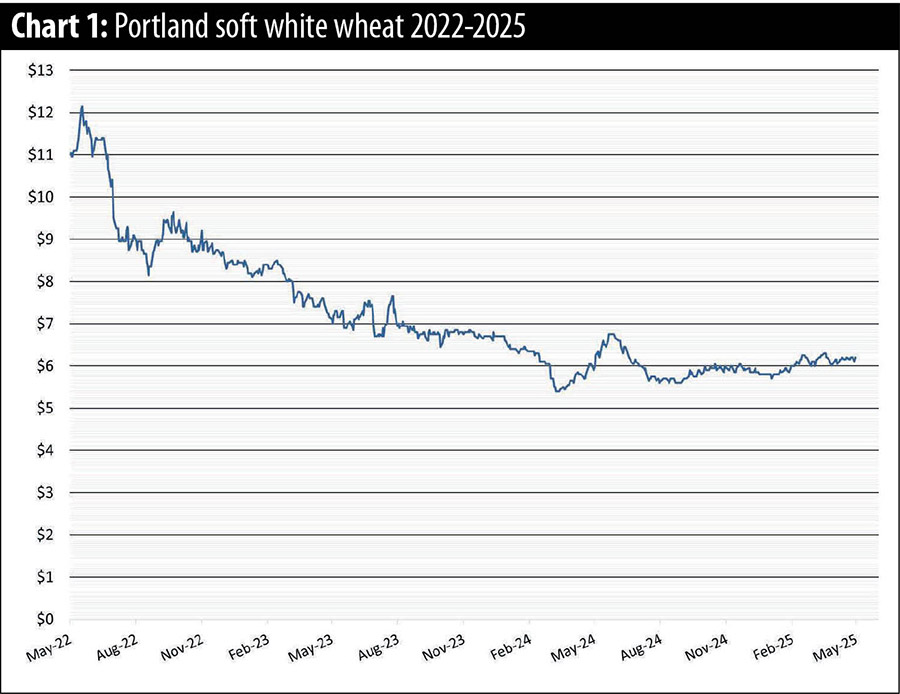

Looking at market trends since 1973 (52 years), market prices during the marketing year (May to April) have trended down 28 of those years, or 54% of the time. If we look at the data more closely, those market trends often cross over into the next market year, and we are presently in that situation. We are currently in the third year of a downward trending market. See Chart 1.

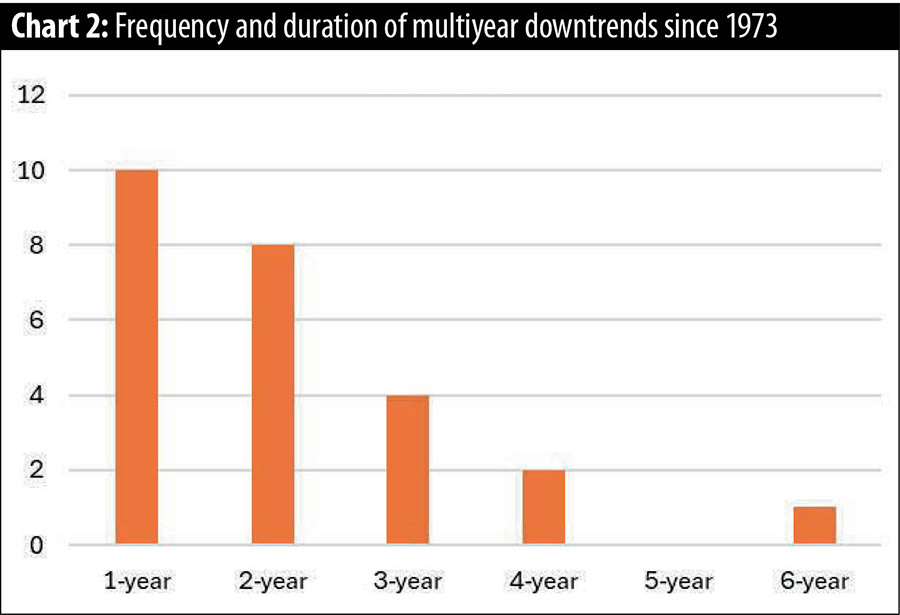

Looking at the data since 1973, the market trend has changed from an upward-trending market to a downward-trending market 10 times. Of those 10 years, the downward trending market continued eight times into a second year. Of those eight years, the trend continued into a third year four times, and of those four years, the trend continued into a fourth year two times, and of those two years, the trend continued into a sixth year one time. See Chart 2.

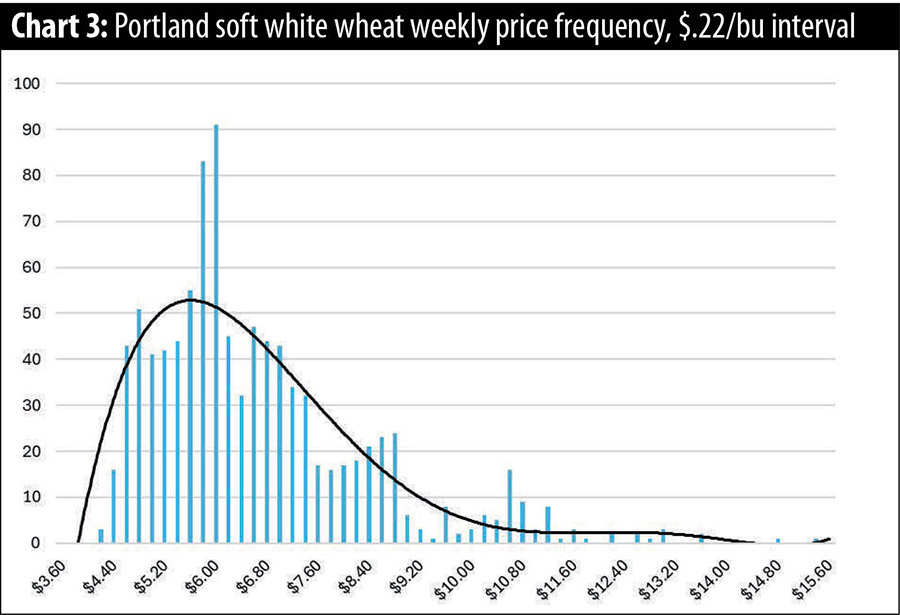

Once we’ve decided that we are in a downward-trending market, we need to decide if we have a good price. Let’s look at the price frequency for Portland soft white wheat since 2006. See Chart 3.

You can see that we have a curve that is not normal but is right skewed. If we use the recommendations for working with data that is not normal, the top price of the frequency range should be $10.30 per bushel. We could establish our good price goal to be a percentage of that top price. This would be your personal choice based on your estimated cost of production and level of risk acceptance. My personal choice is that a good price occurs when prices are above 80% of the top of the range, or $8.24 per bushel.

The final thing we need to consider is the quantity we are willing to forward price. This is where things get sticky. We recognize now we have entered into an area where we are projecting our cropping rotation based on current market prices, what our expected yields will be, and what disasters may/could happen on our farm. It also depends on how much time remains until harvest. If it is May and there are three months until harvest, you have more confidence in your estimate of bushels to market than if you are considering pricing next year’s crop, 15 months away.

There are three ways to forward price:

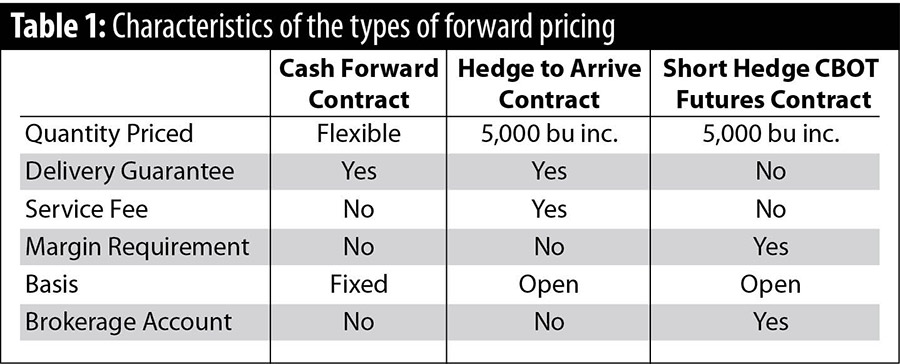

- Cash forward contract. This is the most common and easiest method to forward price. You can contract a flexible amount but are required to deliver that amount of wheat to your grain buyer.

- Hedge to arrive contract. This contract is normally based on a CBOT futures contract. Your final sales price hasn’t been determined yet because the basis is open. Your final price will be the cash price of soft white wheat plus the profit/loss from the hedge to arrive contract. Your grain buyer will charge you a service fee based on the length of time the contact will be in place. Delivery of the grain to your grain buyer is required.

- Short Hedge CBOT futures. This contract is similar to the hedge to arrive contract in that the final price is not determined yet. The final price will be the cash price of soft white plus the profit/loss from the short hedge. Delivery of grain is not required so you can price a higher amount without fear of under delivery. Margin is required to be deposited into your brokerage account, and if the future market moves higher than your hedge price, more money will need to be deposited to cover your unrealized loss. The margin required could be a cash flow issue unless you have enough working capital or a loan agreement with your banker separate from your operating loan to cover the margin requirement.

Table 1 summarizes the characteristics of the types of forward pricing.

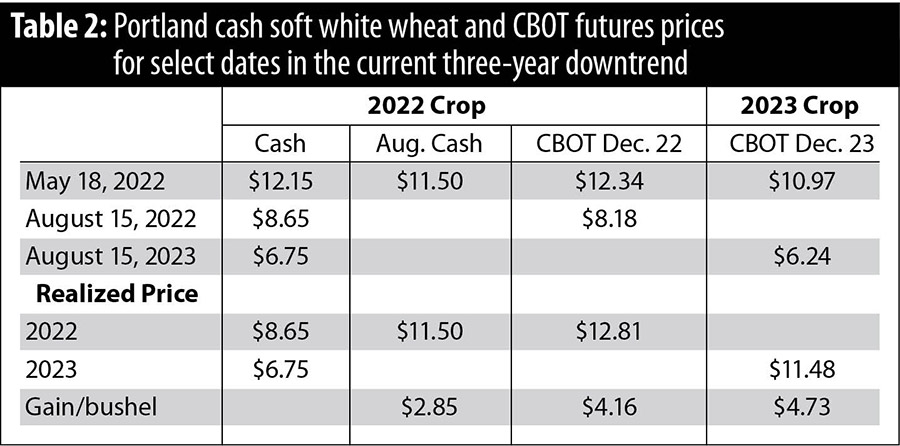

The most common reason that growers do not forward price is the fear they may have a crop issue and will not be able to deliver the quantity contracted. The main thing is to only contract an amount you are comfortable with or a minimum amount that you feel would be produced in a bad production year. In a situation where you have under delivered on your contract but the price has dropped, you technically could buy the shortage from your buyer at the lower price to fill your contract. Your grain buyer may allow you to amend your contract in this situation as they should be able to cover your shortage with wheat they are buying from other growers. The worst situation would be if the price has gone higher. Your grain buyer would require you to cover the loss of the difference between the contracted price and the current price. Table 2 shows the prices that growers experienced in our current three-year downtrend.

The Portland soft white wheat market hit a high of $12.15 per bushel on May 18, 2022. At that time, August delivery soft white wheat was $11.50 per bushel. Three months later, on August 15, cash prices had dropped to $8.65 per bushel. If the grower took a cash forward price, he would receive $11.50 per bushel, an additional $2.85 per bushel more than the cash price. If the grower took a hedge to arrive contract, he would have received $12.81 per bushel, an additional $4.16 per bushel more than the cash price. The hedge to arrive contract performed better than the cash sale because the basis changed in favor of the farmer (the basis relationship between soft white wheat and CBOT is complicated and should be covered in a separate discussion). A hedge to arrive or short CBOT futures contract for 2023 production would have netted a price of $11.48 per bushel on August 15, 2023, when the cash price was now $6.75 per bushel. The 2023 crop hedge was nearly equal to the cash forward price of $11.50 per bushel for August 2022 delivery.

Forward pricing is a practice that could extend good prices into additional years (of good prices). Commodity prices are volatile and tend to have moves that extend for multiple years. Growers should learn to use these forward pricing strategies for downward-trending markets in future years.

Howard Nelson is a retired agronomist and commodity broker. He worked for 31 years in the PNW grain industry and retired in 2020 from HighLine Grain Growers. He has a bachelor’s degree in agronomy from Washington State University and currently lives in Kennewick, Wash., with his wife, Cheryl. Nelson can be contacted at howardnelson73@gmail.com.