Looking ahead Extreme volatility will bring challenges, opportunities for prepared producers

2022April 2022

By Trista Crossley

Editor

Last month, Dr. David Kohl warned producers that a period of extreme economic volatility is approaching, but along with the challenges it will bring, there will also be opportunities for producers who are prepared.

“I think it’s a new era of prosperity if you follow a certain management mindset. If you don’t, I think it’s going to be a temporary opportunity, and it’s going to be up to you which direction you want to go,” he said.

Kohl is an academic hall-of-famer in the College of Agriculture and Life Sciences at Virginia Tech in Blacksburg, Va. He travels extensively, talking to stakeholders about future trends in the agriculture industry and the economy. He was talking to Eastern Washington producers as part of the Agricultural Marketing and Management Organization’s 2022 workshops.

Kohl listed 10 macroeconomic disruptions that producers need to watch that will create both challenges and opportunities:

- A very fragmented U.S. trade policy. The U.S. is moving from globalization to deglobalization, accelerated by the Russia/Ukraine situation. That’s an issue because one in five dollars in U.S. net farm income comes from export markets.

- Environmental, social and governance standards. Kohl explained that the big companies are under pressure from activists, investors and consumers to meet these standards. “More and more ag producers are going to be scorecarded because the companies you sell to and buy from are being scorecarded.”

- The oil and energy complex. Eight out of every 10 dollars a farmer or rancher spends is connected to oil and energy.

- Labor shortage/automation.

- Technology. Kohl explained that a critical element that will give producers a competitive edge is the data they can collect, which can help them make strategic adjustments in their business.

- Government stimulus funds.

- Extreme weather and climate change. Both of these are going to create extremes in economics. Producers also need to watch growing conditions in other areas of the world.

- China. Not only is it America’s biggest trading partner, but its economy is slowing down. This could be critical for commodity prices moving forward.

- Russia and China’s political and military strategies.

- Supply chain challenges, especially related to ports and trucking.

Another important factor for producers to watch is inflation, which Kohl said is the highest it’s been since 1984, and producers should expect to be managing in an “inflationary environment” for at least the short term. How long it lasts depends on many factors, including relief in supply chains, the lack of confidence by U.S. and global consumers, automation and government debt. The federal government has been signaling interest rate increases.

“The feds are going to have to be real careful, because they could throw the U.S. economy and the world economy into a recession,” Kohl explained. “People are going to watch these interest rate increases, and their consumer habits will be adjusted depending on what goes on.”

To deal with the expected volatility and to take advantage of opportunities, Kohl suggested producers institute a three-point program. The first thing they need to do is know their cost of production so they can execute a marketing and risk management plan. They also need to manage their expenses line-by-line and review their financials at least quarterly. Finally, with interest rates predicted to rise, producers need to closely watch any credit that is on a variable rate.

Besides managing economic volatility, producers will also need to learn to manage around the “uncontrollable,” such as what happens in Washington, D.C., or other parts of the world. They will need to be prepared to adapt, innovate and focus, and the older generation needs to take a close look at their management transition plan, which Kohl called a potential “Achilles’ heel.” He explained that too many producers wait too late to do this.

“People are buying hard assets (land), and if you are, you’d better have a transition plan in place for that next generation,” he said.

From 2004 to 2014, government payments as a percentage of net farm income was very low, but that has changed in the past five years. According to the Center for Farm Financial Management, government payments made up 62 percent of net farm income for crop farmers in 2020. For dairy farms, it was 72 percent. For hog farmers, it was 127 percent, and for beef farmers, it was 108 percent.

“We were very government-payment dependent, and government payments makes passive managers,” Kohl said. “The big point I’m trying to make is a new era of prosperity is going to (need to include) a plan to move away from government payments.”

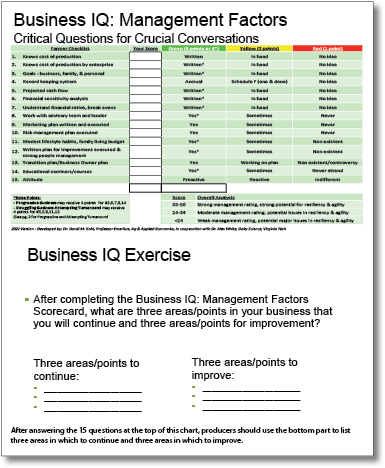

To help producers increase their odds of business success, Kohl introduced a set of 15 business IQ questions (see chart). He said the questions will help producers screen their team for attitude, will assist them in prioritizing improvements and provide an objective way to measure those improvements. After answering the questions, producers should list three areas in which to continue and three areas in which to improve.

“One of the fastest growing trends I’m seeing in agriculture is informal or formal advisory teams,” Kohl said. “Your lender is on it. Your crop consultant is on it. Your livestock consultant is on it. You can’t go it alone today.”

Kohl closed out his presentation by listing four practices that will increase producers’ odds for business success.

- Have strong working capital. This helps navigate volatility, face adversity and positions producers for opportunity. Producers need to look at current assets minus current liabilities. “If you can be 22 to 25 percent of your expenses, you are in a pretty good position to handle all this volatility. You can sell when you want to sell, not when you have to sell. You can have that marketing and risk management program, and you can execute. You can buy those inputs at an opportune time.”

- Watch debt levels. Take net income plus interest paid and depreciation and add them together. Divide that number into term debt. Kohl said if that number gets above 6 to 1, producers “better be tapping their brakes on debt.”

- Operation efficiency. Producers should target a 60-30-10 plan for profits. That means 60 percent of their profits go to build efficiency first and then growth. Thirty percent goes to build working capital, and 10 percent is table money. “The mistake people will make is growing their business before they get efficient. If you aren’t efficient, you have a negative margin, and you only compound your losses.”

- Cash flow planning is 80 percent of a business plan.