Marketing friend or foe? Understanding soft white wheat versus CBOT basis

2025August 2025

By Howard Nelson

Special to Wheat Life

I was asked if I would write an article explaining the basis relationship between soft white wheat (SWH) and CBOT wheat futures, so here we go! I felt that this relationship could be best explained if I compared/contrasted the hard red winter wheat (HRW) KCBOT basis relationship with the SWH CBOT relationship.

The market class of HRW has a true basis market. This means that the grain buyer indicates his market price by stating the amount (basis) that they are willing to pay over a stated futures contract month. It would go like this, “40 over the May KCBOT contract.” To get the cash price, you need to add $.40 per bushel to the currently trading May KCBOT contract price of $5.61 per bushel to get the current HRW wheat cash price delivered to Portland of $6.01 per bushel. This market price fluctuates during the day along with the movement of the futures contract, and buyers will typically only buy while the futures market is open and trading. The basis amount frequently doesn’t change for days or even weeks. Let’s put this into a formula that may be easier to see: Basis + KCBOT Futures Price = HRW Portland Market Price

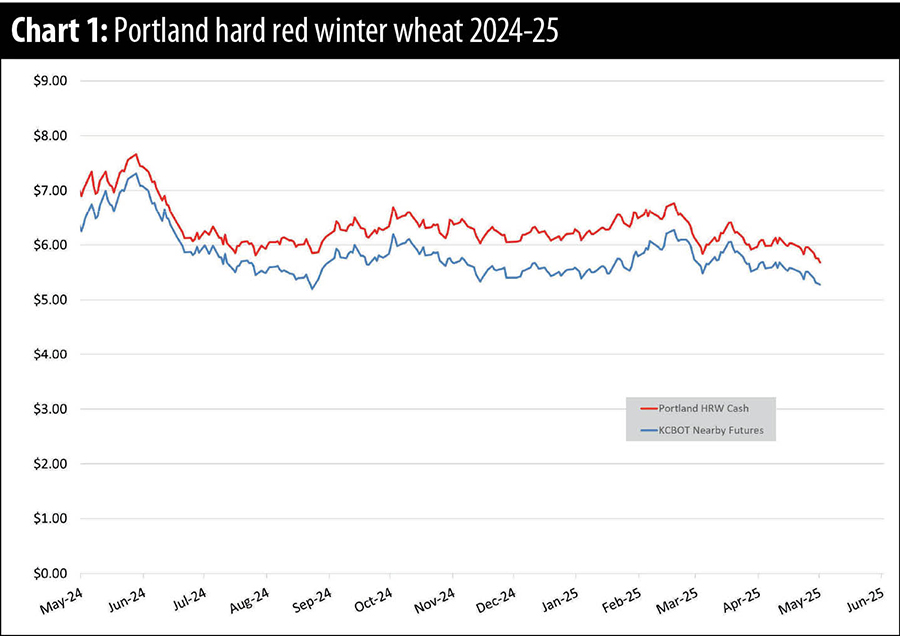

Chart 1 shows the Portland HRW wheat price for the 2024/25 marketing year and the nearby KCBOT futures price. The difference between the two lines is the HRW wheat basis. This marketing year to date, we’ve had a high HRW basis of plus $.81, a low basis of plus $.04, a basis range of $.77 per bushel, and an average basis of $.48 per bushel.

The market class of SWH has a flat price market and doesn’t have a futures exchange of its own. The closest exchange to SWH is the CBOT exchange that is based on the soft red winter wheat market class. It is the same commodity (wheat) but a different market class. This causes things to get complicated. The grain buyer will indicate his market price like this: soft white wheat for May delivery to Portland is $6.15 per bushel. The SWH cash price is indicated each half day and doesn’t usually change during the half day but can. The SWH basis will change while the CBOT futures is trading, and when that basis is referenced, it is usually the basis amount that was present at the close of futures trading. The formula for the soft white basis is this: SWH Portland Market Price – CBOT Futures Price = SWH Basis

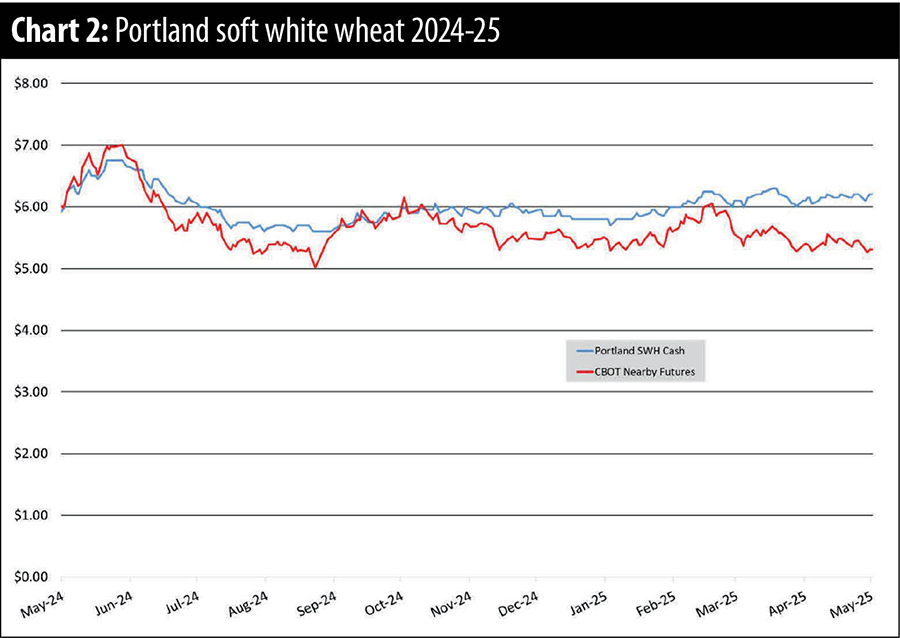

Chart 2 shows the Portland SWH wheat price for the 2024-25 marketing year and the nearby CBOT futures price. The difference between the two lines is the SWH wheat basis. You can see that the basis started the marketing year with an under basis (less than 0), moved to an over basis (greater than 0), went to an even basis (equal to 0) and then went back to an over basis. This marketing year to date, we’ve had a high SWH basis of plus $.90, a low basis of minus $.29, a basis range of $1.18 per bushel and an average basis of $.32 per bushel.

Chart 2 illustrates the variable relationship between Portland SWH and the CBOT futures market. If a futures market is to be a reliable marketing tool, there needs to be a good correlation between the futures market and the cash market. In addition, price risk should be reduced when using that futures market. Let’s see how the HRW wheat and SWH markets meet these criteria.

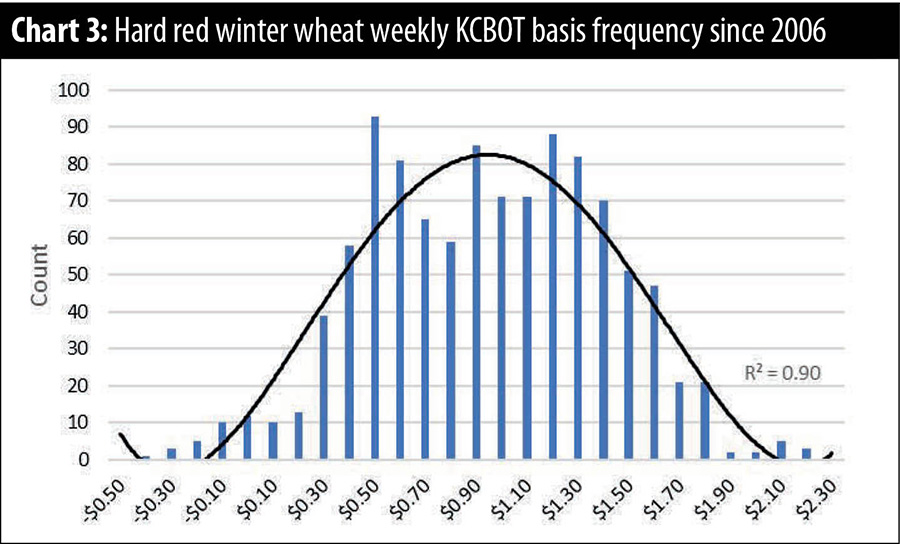

As you would expect, Portland HRW wheat prices have a very strong relationship with KCBOT futures prices. Over the past 19 years, every year has had a very strong correlation, with an average correlation of 95%. Since 2006, the weekly average basis averaged plus $.89 per bushel and had a median price of plus $.90 per bushel. There was an over basis (great than $.03) 96.6% of the time, an even basis (plus or minus $.03) .8% of the time, and an under basis (less than $.03) 2.6% of the time. There were 19 outliers at 1.9% of the total. A frequency chart of the HRW basis is shown in Chart 3.

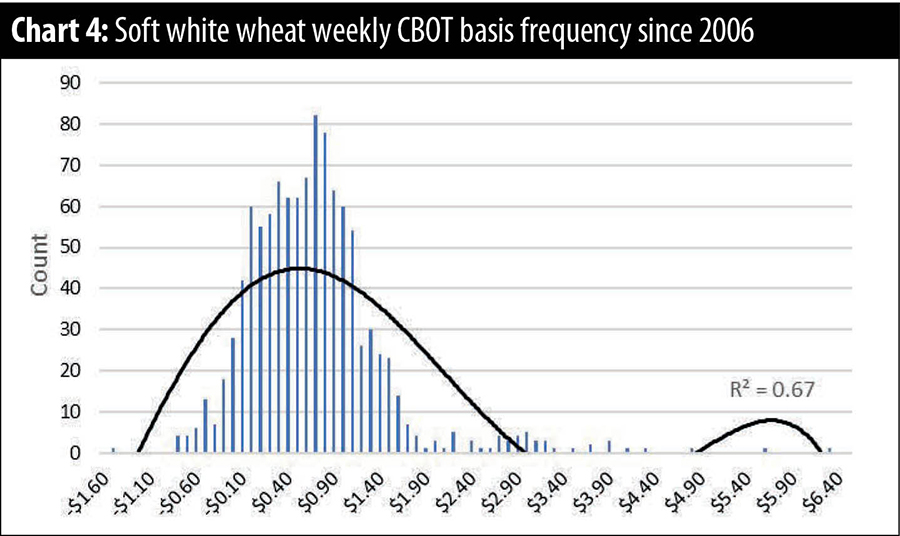

SWH wheat prices have not had such a strong relationship with CBOT wheat futures but still has a good correlation, averaging 68%. There was only one year since 2006, 2007-08, that had a weak correlation, and 14 of those years, 74%, had a strong to very strong correlation. Since 2006, the weekly average basis averaged plus $.63 per bushel and a median price of plus $.57 per bushel. A frequency chart of the SWH basis is shown in Chart 4, and it is right skewed. There was an over basis (greater than $.03) 79.7% of the time, an even basis (plus or minus $.03) 4.5% of the time, and an under basis (less than $.03) 15.9% of the time. There were a higher number of outliers totaling 67, 6.8% of the total.

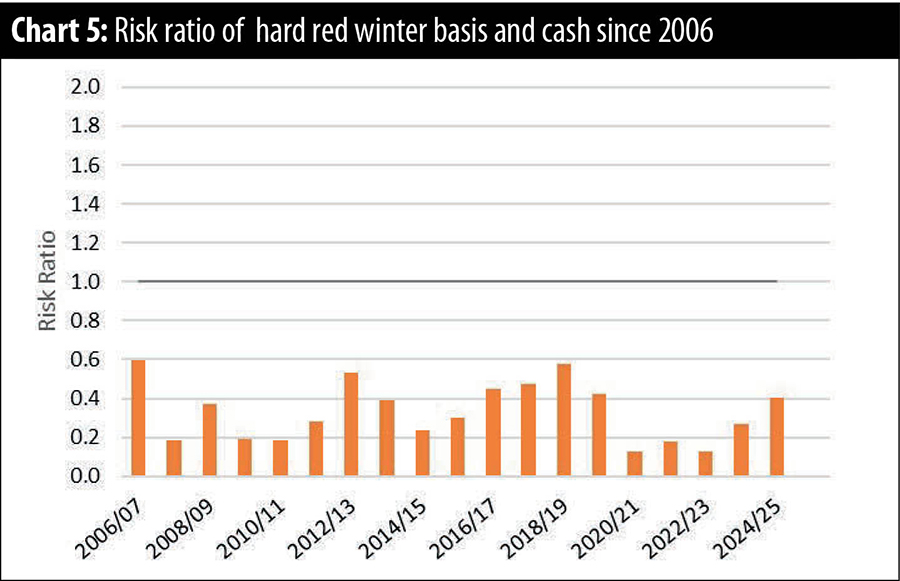

One reason to use wheat futures markets is to manage price risk. The definition of price risk can be made several ways, and one definition is how much the price ranges between the high and the low during the marketing year. The use of futures markets fixes the futures portion of the price but leaves the basis open. This basis remains open until the futures portion of the price is lifted, and the wheat is priced in the cash market. Lowering risk means that you want to lower these price ranges as much as you can. Let’s compare the marketing year price range of the cash market to the range of the basis. Let’s put this into a ratio for comparison by dividing the basis range by the range of the cash market. A ratio number less than one means that the basis risk was lower than the cash market risk, and a ratio number greater than one means that the basis risk was higher than the cash market risk. The HRW risk ratio shows that the use of futures markets lowered risk, and the ratio was below one for all years. The ratio was never higher than .60 and had an average of .33 (Chart 5).

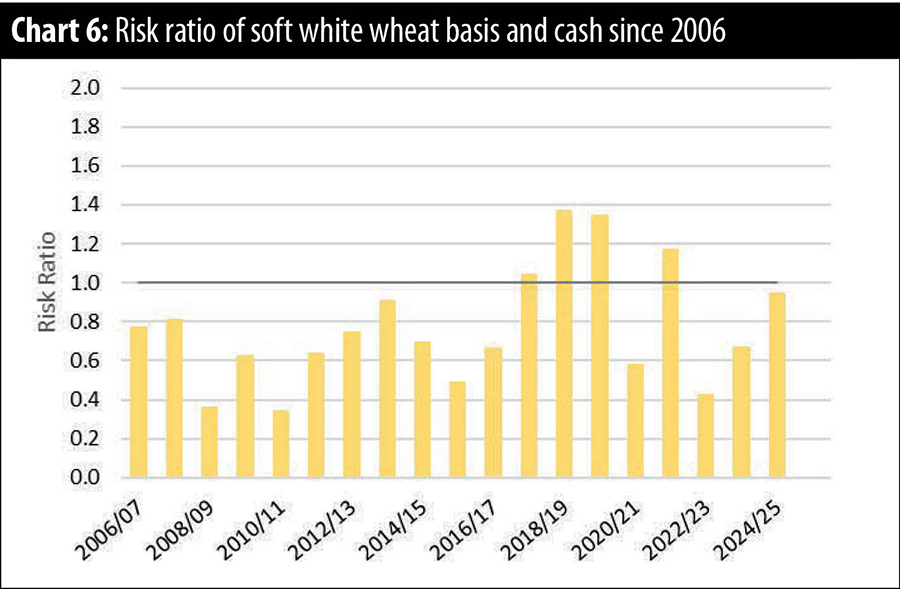

Chart 6 for SWH shows that risk is not always reduced by the use of CBOT futures. The average of the risk ratio was .76 but there were four years that the ratio was greater than one, showing that basis risk was greater than the cash market risk in those years.

What does all of this mean for the average farmer? If the marketing tools that you use are limited to the cash market, you don’t need to worry about basis and basis risk. If you use hedge-to-arrive contracts, minimum price contracts, or the futures markets in any way, then basis and basis risk are important. The hard red winter wheat grower has a better situation than the soft white wheat farmer with a good correlation between cash and futures prices and the ability to use futures to control risk if desired. The soft white wheat grower can use CBOT futures tools for marketing, but needs to understand the limitations and potential pitfalls of using the CBOT futures market.

Howard Nelson is a retired agronomist and commodity broker. He worked for 31 years in the PNW grain industry and retired in 2020 from HighLine Grain Growers. He has a bachelor’s degree in agronomy from Washington State University and currently lives in Kennewick, Wash., with his wife, Cheryl. Nelson can be contacted at howardnelson73@gmail.com.