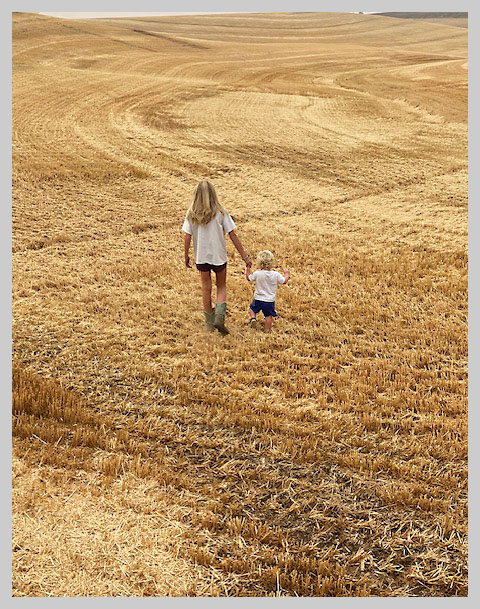

Ask an ag producer what three things they consider key to the overall success of their farming operation, and the prevalent response will be hard work, honesty and family relationships.

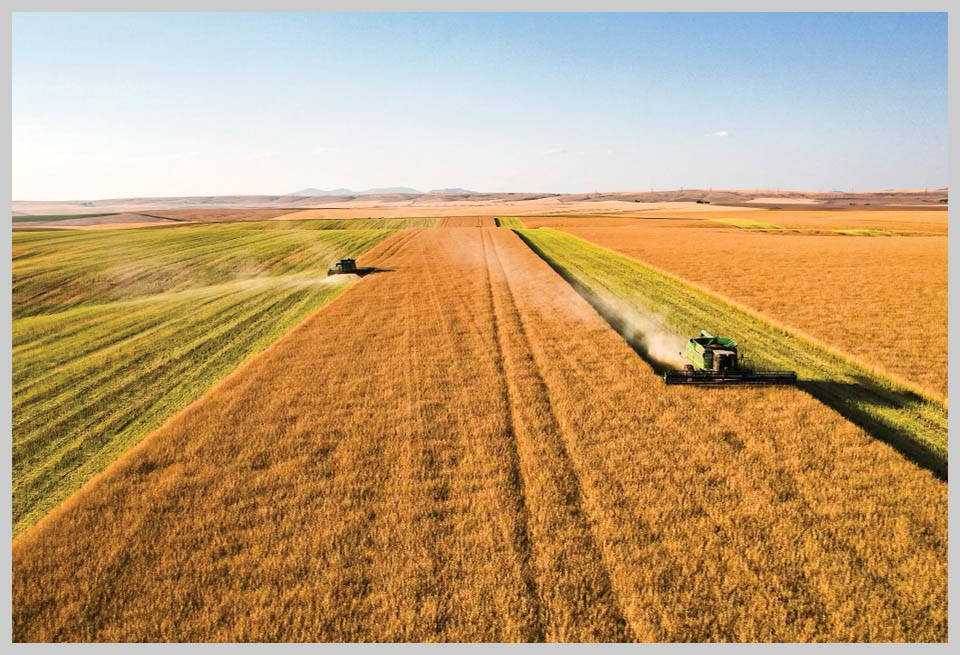

There isn’t a day that goes by that your farming operation doesn’t rely heavily on each of these key components in some way: the crop needs harvested ahead of the rain, a late correction to a grain division error in favor of your landlord or partner after it is delivered to the elevator, or extra effort put in by members of your family who personally sacrifice to build a lasting legacy.

These same keys are required for a successful retirement transition. As a producer starts to see the sunset coming, there are important questions to ask, most of which will require hard work in thought as well as action and an honest consideration of what the best course of action will be. Some of the hardest and most far-reaching questions (specifically when it comes to family relations) revolve around the direction of the underlying farmland and the necessary steps to ensure it will continue to provide for generations to come.

Let’s focus on two important farmland questions:

• Will the farmland be leased?

• Will the farmland be sold?

If the best path forward during retirement includes leasing the farmland (to a family member or outside farm tenant), determine what a fair lease arrangement will be to ensure the farmland is cared for properly. These arrangements include:

• Determining if cash rent or crop share is best. Both scenarios have market implications and risk, however, it will be clear to the knowledgeable producer that the land can only produce rental commensurate with outside market conditions. Proper lease structure provisions can be incorporated into the document to ensure the rental terms adjust to up or down movements in the market. Our recommendation to landowners is to be realistic in rental income type and projections since each year, market factors will trend up or down.

• Length of lease agreement. This determination is one of the most challenging questions to answer for landowners and farm tenants if both sides intend to work long term together. However, the encumbrance of a long-term lease on the underling farmland can be detrimental to overall farmland value as well as the ability for both sides to shift quickly enough to respond to ever-changing market conditions. Our recommendation to landowners and farm tenants is to earnestly enter into lease agreements in durations of three to no more than five years. This allows for enough commitment and flexibility to be extended to each party.

• Maintenance considerations. Many farms have improvements such as buildings or irrigation equipment that will continue to age into the future. Determining who will care for the upkeep and replacement of these components will maintain durability and safeguard peace of mind. Our recommendation to landowners is to annually fund a capital reserve account apart from other funds to care for landowner farm improvements.

An honest look at question #2 may cause most of us to recoil at the thought of selling any farmland. It just isn’t in the nature of most farm families to sell something that took so much time, effort and sacrifice to acquire. Yet, if we are working hard to be honest with ourselves and our family, the reality of the financial requirements that may come in retirement may include selling a portion of the farm to accomplish and thrive in this new phase of life. Important things to consider when selling farmland include:

• Financial debt. Depending on current liabilities, selling farmland may be necessary to manage or eliminate various forms of debt into retirement. Continuing any form of debt/leverage into retirement — even if the payments can be made from leasing activities — will add unnecessary risk to the overall financial plan. Our recommendation to landowners is to pay off all debts during the transition phase into retirement and shift the risk of leveraged ownership to another.

• Tax Implications. With time and planning, the tax implications of owning and selling farmland can be reduced, but in all honesty, they will likely not be eliminated. The transition period to the next generation or another form of investment can also be a time to reduce overall tax liability. Our recommendation to landowners is to ensure there is a capable and active tax accountant on your team prior to retirement.

• Alternative Investments. Consider how to replace the income stream that is currently coming from the farmland. The options for investment of the proceeds that come from the sale of farmland are many and could include financial instruments such as stocks, bonds or other types of real estate investments that yield residuals such as rental income. Our recommendation to landowners is to be careful to only invest in things that have a proven track record and that operationally you understand and can effectively manage.

Working hard to determine the answers to important farmland questions may prove challenging, however the rewards for honestly moving forward will, in the end, yield the greatest benefits to you and your family.

Tim Cobb is a farm kid from Eastern Washington and is the owner of Farmland Company, based in Spokane, Wash. Farmland Company specializes in direct farmland management, real estate brokerage, and consulting across the Pacific Northwest. For more information, visit the company’s website at farmlandcompany.com.